WELCOME MEDICARE MEMBERS!

Shopping for a Medicare plan is HARD! It's complicated to understand and it's just down right stressful for most people! Our job is to advise you on how to best protect your health, your wealth, and your family so that you can go about your daily life well-prepared and worry free!

We understand that insurance is not a one-size-fits-all system and that everyone's situation is unique. That's why we will complete a full assessment of your needs before making a professional recommendation.

YOUR CUSTOM ASSESSMENT INCLUDES...

Review suitability for Advantage vs. Supplement

Cross-check up to 100+ carriers

Cross-check network of providers and specialists

Price check medications and preferred pharmacy

Complete calculations (moop vs monthly premium)

Complete total protection package quotes for all recommended plans & riders

Present top 2-3 recommended plan packages based on assessment score

Online electronic enrollment with online member platform

FINANCE EXPERTS AGREE

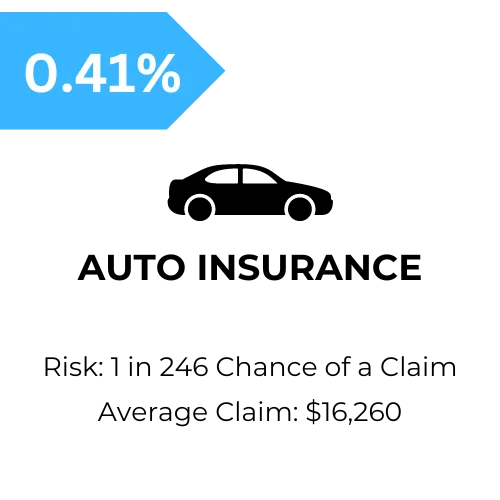

The best way to predict the future, is to look at the past. The data tells us that these are your highest and most costly risks!

NEEDS BY LIFE STAGE?

Young Families Ages 26-40

The Planning Stage

This group is mostly concerned about the cost of living and debt management. Particularly, student loans and credit card balances. They are also raising young kids and are already saving up emergency reserves.

Must Have

Health Insurance

Auto Insurance

Homeowners or Renters

Strongly Encouraged

Dental & Vision

Mortgage Protection Life

Disability Insurance (if working)

Critical Illness age 29+

It's Time To Start

Looking into College Funding

A Tax Sheltered Retirement Account

Nearing Empty Nest Ages 41-55

The Accumulation Stage

This group is currently carrying the highest debt load, while still working, raising children and saving for retirement. Now is a good time to look at funding for Long Term Care and at re-evaluating your savings goals to ensure you're on track to meet your retirement needs.

Must Have

Health Insurance

Auto Insurance

Homeowners or Renters

Disability Insurance (if working)

Long Term Care (if you have assets to protect)

Life Insurance

Retirement Plan

Strongly Encouraged

Dental & Vision

Critical Illness

It's Time To Start

Making a plan for Long Term Care funding

Nearing Retirement Ages 56-64

The Preservation Stage

This group is very busy working, saving and still financially supporting children. In many cases, they are caring for aging parents as well. It's time to start looking at "income for life" plans to ensure you don't outlive your money in retirement.

Must Have

Health Insurance

Auto Insurance

Homeowners or Renters

Disability Insurance (if working)

Long Term Care (if you have assets to protect)

Life Insurance

Retirement Plan

Strongly Encouraged

Dental & Vision

Critical Illness

It's Time To Start

Re-evaluating (and rebalancing) your retirement savings to ensure it still aligns with your goals.

Be sure you have funding for Long Term Care firmly in place. Rates beyond this age group are VERY expensive.

Retirement and Beyond Ages 65+

The Income Stage

This group holds the most wealth in the U.S. They've worked and saved their entire lives and are now looking to help kids and grandkids get set on the right track. It's time to move riskier growth investments into fixed, to preserve assets and ensure you don't outlive your income.

Must Have

Medicare Insurance

Auto Insurance

Homeowners or Renters

Long Term Care (if you have assets to protect)

Final Expense or Life Insurance

Retirement Plan

Strongly Encouraged

Dental & Vision

Annuity

It's Time To Start

Re-evaluating (and rebalancing) your retirement savings to ensure it still aligns with your goals. Move high risk assets into fixed and secure investments. Annuities are a popular choice for asset preservation at this stage.

HEALTH & WELLNESS SOLUTIONS

Pays Your Health Providers

HEALTH

INSURANCE

Covers claims for inpatient services, outpatient services and prescription drugs for members ages 0-64.

More

Why it's needed?

Avg cost of injury: $9,992

Avg cost of diabetes: $19,807 Yr.

Avg cost of cancer: $147,000+ Yr.

Recommended for:

Ages 0-64

Avg cost of coverage: 0% - 8.5% of Income

MEDICARE

PLANS

Covers claims for inpatient services, outpatient services and prescription drugs for Medicare members.

More

Why it's needed?

Avg cost of injury: $9,992

Avg cost of diabetes: $19,807 Yr.

Avg cost of cancer: $147,000+ Yr.

Recommended for: Medicare members only

Avg cost of coverage: $175 - $350+ per mo.

DENTAL

& VISION

Covers claims for oral & optical health services, prescriptions & appliances for ages 1-100+.

More

Why it's needed?

For every $1 spent on dental wellness, $3.00 is saved in future needs. Recommended for: Ages 1+

Avg cost of coverage:

Discount only: $7 per mo

Insurance plans:

$20/ child $45/ adult.

LONG TERM

CARE

Neither health insurance nor Medicare pay for LTC. The only way to pay for this is with your own funds, a LTC policy OR if you can qualify for Medicaid.

More

Why it's needed?

Strict rules prevent you from transferring assets to someone else and Medicaid can come after your estate for reimbursement if they help pay your LTC bills.

The average cost of private nursing care is over $110K per year.

Recommended for: Ages 40+ with assets to protect.

Avg cost for coverage: $99-$999 per month.

FIXED

INDEMNITY

These are reimbursement plans that pay YOU or your provider, the specified cash benefit if you suffer a qualifying illness or injury...

More

For example: PLAN A will pay you $1,000 upon a hospital admission, $50 for a doctor visit, $75 for specialist visit and $25 per prescription. PLAN B offers double the coverage of PLAN A.

Recommended for: Members with health insurance or Medicare, concerned about still having out of pocket medical expenses like deductibles and copays.

Avg cost for coverage: $55-$99 per mo.

TRAVEL

INSURANCE

Covers health emergencies, medical evacuation, trip cancellation expenses, lost luggage and more.

More

Why it's needed?

Travel can be VERY expensive and because last minute issues can arise, this coverage offers "cancel for any reason" investment protection. Also, most traditional health plans do not offer coverage outside of the US border.

Recommended for: All international travelers

Avg cost for coverage: 5% - 10% of total trip investment.

ASSET PROTECTION SOLUTIONS

Pays You Cash to Help Avoid a Financial Catastrophe

ACCIDENTAL

INJURY

Helps pay your deductible and other out of pocket expenses due to injury. This is your highest risk.

More

Especially for those with active lifestyles, athlete's and those with kids in the home.

Recommended for: Anyone concerned about having to meet a high deductible suddenly and all at once.

Avg cost for coverage: $20 per mo per person for $5,000 coverage

CRITICAL

ILLNESS

Pays a lump sum upon diagnosis of a critical or terminal illness. Average recovery time could mean 3-6 months without income.

More

Why it's needed?

You have almost a 50% chance of a cancer diagnosis and it will cost the average family $52K of their own savings due to loss of wages (avg recovery: 3-6 mo) and expenses insurance doesn't cover.

Recommended for: All members age 29+ without these funds readily available for use.

Avg cost for coverage: $42.28 mo for $50K (male, 45).

DISABILITY

INCOME

Pays monthly cash benefits for a specified time period to cover loss of income due to a qualified illness or injury.

More

Why it's needed?

You have a 25% chance of a disability before age 65 and this coverage insures your income so you can still pay your bills while you're out of work.

Recommended for: All members who depend on "earned income" to meet their monthly obligations.

Avg cost of coverage: 1.5% - 3% of annual income

LONG TERM CARE (HYBRID)

Death benefit policy with cash benefits available for Critical Illness, Terminal Illness, Disability and Long Term Care.

More

Unused death benefits payable to beneficiary. Funds move tax free. Can be rented or owned.

MORTGAGE PROTECTION

Cash protection that pays off your mortgage balance upon the death of the insured.

More

This coverage is unique in that the death benefit amount, decreases along with your mortgage balance offering incredible affordability! Don't pay full price for a term policy if a portion of it is intended to pay off your mortgage. This strategy is less expensive.

TERM LIFE

INSURANCE

Rental death benefit policy with cash benefits available for Critical Illness, Terminal Illness, Disability and Long Term Care.

More

Unused death benefits payable to beneficiary. Funds move tax free. Expires after 10-30 Yrs.

ASSET GROWTH SOLUTIONS

Let's Build the Retirement of your Dreams!

INDEXED UNIVERSAL LIFE

Death benefits payable to your beneficiary tax free. A percentage of the death benefit is available for Critical Injury, Critical Illness, Terminal Illness and Long Term Care. You can also add an "income for life" rider!

More

Triple Compounding Interest. 1.) Floor starts over each year. 2.) Earns interest on the interest 3.) Earns interest on taxes you didn't have to pay (no tax on growth). Participate In the index fund with a guarantee of no losses. Lasts a lifetime. Add the lifetime income rider and receive tax-free income for life!

IRA/401k

ACCOUNTS

Tax favored accounts. Some restrictions on deposit amounts and early withdrawal penalties can apply.

More

Maximize your tax incentives and take full advantage of all the programs available! Or set up a fund to match your employee retirement contributions.

TAX-SHELTERED

ANNUITIES

Turn your lump sum into structured guaranteed payments over time. Or start with an affordable monthly payment and watch your savings grow by participating in the S&P Index with NO risk.

More

Triple Compounding Interest. 1.) Floor starts over each year. 2.) Earns interest on the interest 3.) Earns interest on taxes you didn't have to pay (until withdrawal). Participate In the index fund with a guarantee of no losses. Add the lifetime income rider and receive guaranteed income for life!

ADDITIONAL SOLUTIONS & SERVICES

Get the best value for your dollar with pre-packaged benefits

5-IN-1 FAMILY SECURITY PLAN

Rental coverage that pays cash for critical illness, critical injury, terminal illness and long term care.

More

If benefits go unused, the death benefit pays to your beneficiary tax free.

6-IN-1 TOTAL PROTECTION PLAN

Permanent coverage that pays cash for critical illness, critical injury, terminal illness, long term care and pays income for life!

More

If benefits go unused, the death benefit pays to your beneficiary tax free.

POLICY

REVIEW

Having a professional like me review your current coverage each year is an essential piece of your financial health...

More

You could be over-insured, under-insured or just not have the right coverage all together. You could also be missing out on a new, better suited program and savings.

WANT TO LEARN MORE ABOUT HOW MEDICARE WORKS?

What you'll learn...

The parts of Medicare and how they work together. Parts A, B, D

Your three Medicare Plan options and how they serve your healthcare needs.